Analyzing the Global X NASDAQ 100 Covered Call ETF (QYLD) Between Jan 2, 2020 and Jan 1, 2025

Exchange Traded Funds (ETFs) like QYLD help investors diversify and manage money in ways that are too difficult or expensive for individual investors. One popular US stock market metric is the Standard and Poor (S&P) 500 index which tracks the top 500 US companies with the largest market capitalization. It provides a benchmark investment metric which is difficult for investors to beat year over year.

The operations to track, buy, and sell the top US 500 companies are complex and pricy for an individual investor without automation tools. Thus, index funds and ETFs help investors by figuring out the right investment blend to meet at an affordable price. One example fund is the State Street SPDR S&P 500 ETF Trust (SPY) to buy into the S&P 500.

The NASDAQ 100 is another popular index fund designed to measure the performance of 100 of the largest NASDAQ-listed non-financial companies. While there are similarities between S&P 500 and NASDAQ 100 top 100 companies, a major company with large capitalization, like Berkshire Hathaway, is not a member of the NASDAQ 100. Even though it is in the top 10 currently in the S&P 500, it qualifies as a financial company disqualifying it from the NASDAQ 100. Nonetheless, if you track US companies, odds are you will recognize many in the NASDAQ 100. This link may help individual investors to shop for equities in the NASDAQ 100.

Let us dig one step deeper into the logic behind the Global X NASDAQ 100 Covered Call ETF (QYLD) which is the topic of this blog. Global X is providing funding to cover option calls on equities in the Chicago Board Options Exchange (CBOE) NASDAQ 100 BuyWrite V2 Index. An option gives an investor the right—but not the obligation—to buy or sell a stock at an agreed-upon price and date. A covered call (which assumes the stock will rise) refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.

To execute this, an investor who holds a long position in an asset then writes (sells) call options on that same asset to generate an income stream. The investor’s long position in the asset is the cover because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Global X takes care of this for the QYLD investor.

QYLD Analysis

Money made from the QYLD covered calls is returned as a dividend. The more investors that own QYLD indicates the more calls it can cover. Financial Monkey Blog has analyzed the last 5 years of performance on QYLD thanks to data provided by Yahoo Finance. Let’s take a look at numbers from Jan 2, 2020-Jan 1 2025:

- If you bought QYLD Jan 2, 2020 you paid around $23.74; selling it today would sell for around $18.22 producing a theoretical loss of $5.52.

- However, in that same timeframe, you would have earned approximately 12.22% or $11.91 in dividends. This brings the theoretical loss of $5.52 to a gain of $6.39 which is a 26.92% gain on $23.74.

- Here is QYLD’s distribution history. QYLD on average over the past 5 years pays a dividend of $0.1985 each money per share. The minimum dividend over the last 5 years was $0.16 and the maximum was $0.50.

- This math does not account for taxes on dividends. Taxes vary per investor and the type of brokerage account you have, for example, cash versus an IRA.

- The list of holdings on December 31, 2024 is here which may be found here.

Looking at the Yahoo Finance chart for QYLD Performance over 5 Years. There was a major sell off leading up to the pandemic which dropped QYLD from its high of $24.15 down to about what it trades at today around $18.22. Since then, interest in QYLD picked up and attempted to return to normal. Clearly there is a drop-off in 2022 where the ETF hit rock bottom at $15.39 Oct 14, 2022. Since then, the ETF is growing at a steady rate as it is now about 18.39% above its low.

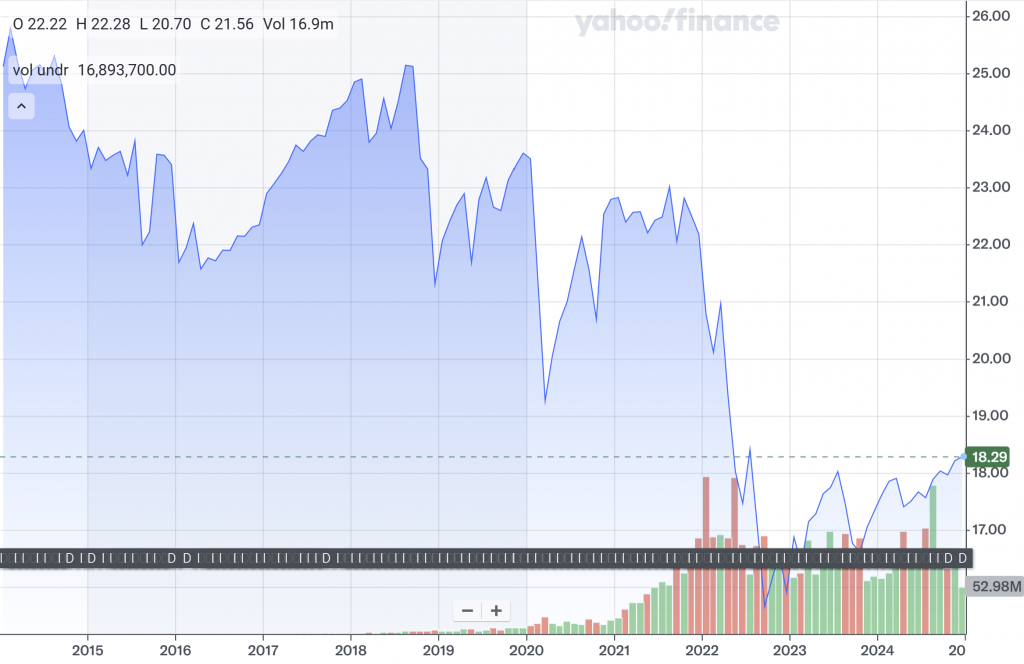

The next Yahoo Finance chart shows QYLD over its lifetime. There is a fairly consistent downward trend from 2014-2022. It was improving from 2016 to 2018, but then again fell short until 2020. Then it improved again in 2021, but that declined which appears to have been accelerated by the pandemic through 2022. Also noted from this chart, the volume traded has also increased since the pandemic. Despite the downward trend, the cumulative performance history since inception is 140.58%.

QYLD News

The news is rather sparse for QYLD. The most major announcements were in April 2024 regarding a major shift in executives at Global X exiting and a new CEO, Ryan O’Connor, taking over the helm. “Change is never easy, but I really see it as a natural evolution of the platform,” O’Connor told etf.com during his first media interview since joining Global X. Global X was acquired by Mirae Asset Global Investments in 2018; they installed Luis Berruga as CEO in 2021 who doubled the size of Global X and brought in $21 billion. But Berruga was fired and an interim CEO filled in until O’Connor was installed.

According to Mirae who responded to a request for comment with the following emailed statement to Yahoo Finance, “We have seen significant momentum and innovation coming out of Global X. In order to maintain that momentum and take the brand to the next level, we made a decision to refocus the company’s strategic direction. Given his significant ETF experience and insights, Ryan is playing a key role in that evolution.” O’Connor worked for State Street, the same company that manages the SPY ETF mentioned earlier in the article. QYLD leads Global X’s portfolio which currently has $8.42 billion in assets.

Read more Financial Monkey business and finance blogs.

Leave a Reply

You must be logged in to post a comment.