Introduction

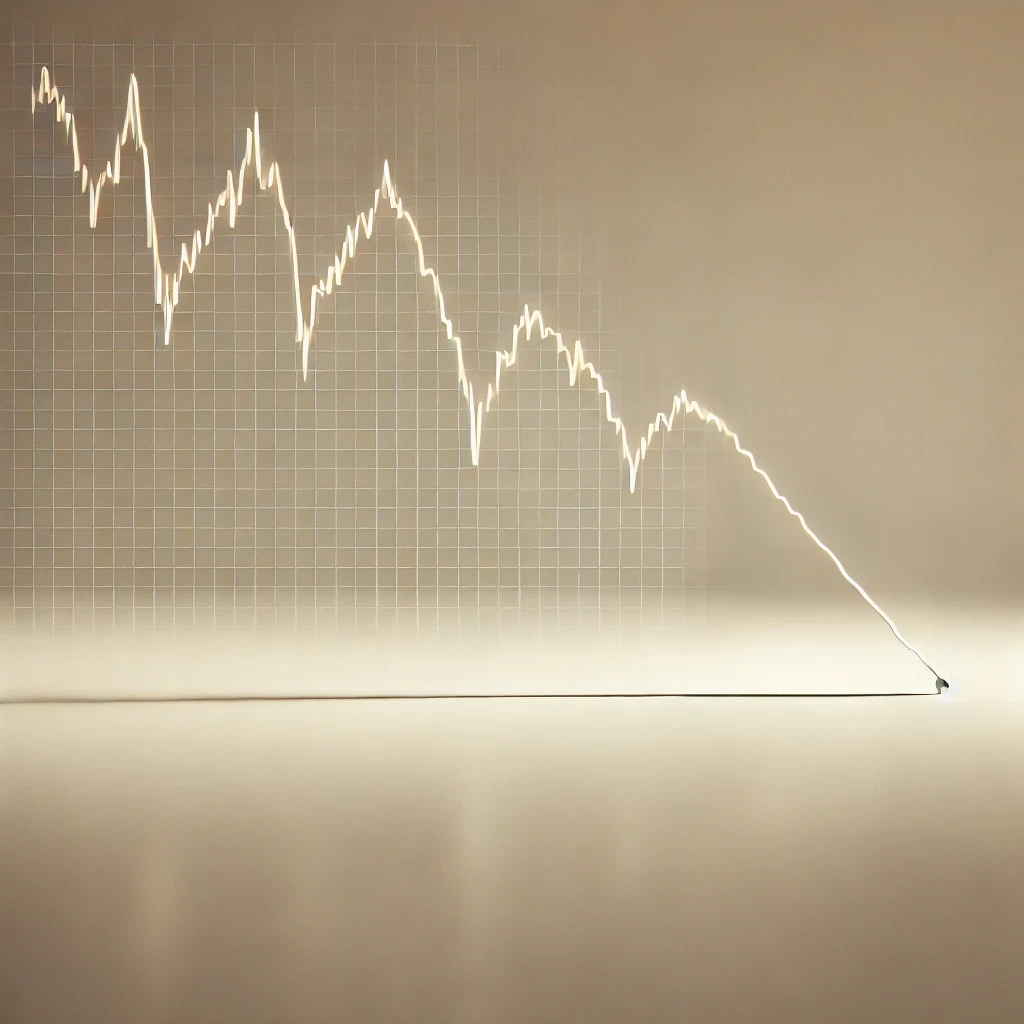

The U.S. stock market has faced significant turbulence in 2025, largely influenced by trade policies. Recent changes in tariffs and global trade agreements have created uncertainty, sparking sharp market reactions and contributing to increased volatility.

Understanding the Current Trade Policy Changes

In early 2025, the U.S. government enacted several new trade policies aimed at strengthening domestic industries and addressing long-standing trade imbalances. While these policies seek to promote local production, they have inadvertently intensified supply chain disruptions and raised production costs for multiple sectors. Understanding the nuances of these policy changes is crucial for anticipating market trends and identifying strategic investment opportunities.

Key Details of U.S. Policies for Tariffs :

- Tariff Increase on Electronics:

- A 15% tariff was introduced on imported electronic components from China, affecting companies across the technology sector, including semiconductor manufacturers and hardware producers.

- The intent behind this tariff is to encourage local manufacturing, but companies like Apple and Nvidia—which heavily rely on Chinese manufacturing—are facing increased production costs and potential delays.

- This move may incentivize companies to diversify supply chains or explore reshoring strategies to mitigate future risks.

- Agricultural Goods Tariffs:

- New tariffs on agricultural imports from Mexico have disrupted the supply and pricing of staple goods like fruits, vegetables, and grains.

- The policy aims to support U.S. agriculture but has led to increased costs for food distributors and processors, including major players like Archer-Daniels-Midland.

- Consumers are seeing higher prices, while companies must navigate higher operational costs and potential margin compression.

- Steel and Aluminum Duties:

- Tariffs on imported steel and aluminum rose by 20%, designed to bolster domestic metal industries.

- While this benefits local producers, it has significantly increased input costs for industries like construction and automotive manufacturing.

- Companies such as Ford and General Motors have publicly stated that these higher costs may result in reduced profit margins and delayed projects.

Stock Market Impact of Tariffs Policy Change

These trade policies have had immediate and widespread effects across the U.S. stock market. Investor sentiment has been influenced by concerns over profit margins, supply chain delays, and global trade retaliation. Each sector has faced unique challenges in adapting to these changes.

Sector-Specific Impacts:

- Technology Sector:

- Companies like Apple and Nvidia experienced stock price declines of 3-5%, largely due to rising manufacturing costs and potential disruptions in product delivery timelines.

- Smaller tech firms, particularly those lacking diversified supply chains, are facing heightened operational pressures and greater exposure to profit volatility.

- Agricultural Sector:

- Major agricultural firms, including Archer-Daniels-Midland and Cargill, have seen an average decline of 4% in stock prices.

- Elevated import costs have directly impacted profit margins, while the rising prices of goods may lead to reduced consumer spending on agricultural products.

- Manufacturing and Construction:

- Industries reliant on steel and aluminum, such as automotive and infrastructure projects, reported significant cost escalations.

- The S&P 500’s industrial sector index fell by 6%, reflecting the market’s reaction to increased production expenses and lowered profit forecasts.

Investment Strategies for Navigating U.S. Market Volatility

In this high-volatility environment, investors must employ strategic, well-researched approaches to safeguard and grow their portfolios. Below are detailed investment strategies designed to mitigate risks and capitalize on market shifts:

- Diversification:

- Spread investments across multiple sectors, industries, and asset classes to minimize exposure to industry-specific risks.

- Consider diversifying into commodities, real estate, and international stocks, alongside traditional equities.

- Focus on Domestic Producers:

- Prioritize investments in companies with strong domestic production and sourcing capabilities.

- For instance, investing in local agricultural producers or U.S.-based tech manufacturers can reduce exposure to international tariff risks.

- Dividend Stocks:

- Opt for companies with a reliable track record of dividend payments, such as Coca-Cola or Procter & Gamble.

- Dividend stocks offer a steady income stream, providing financial stability even during market downturns.

- Commodity Investments:

- Hedge against rising costs in vulnerable sectors like agriculture and metals by investing in related commodities or ETFs (e.g., SPDR Gold Shares or Invesco Agriculture Fund).

- Such investments can act as a buffer against market volatility driven by tariff-induced cost fluctuations.

- Monitor Policy Developments:

- Stay informed about legislative changes and government policy shifts that may impact market dynamics.

- Utilize financial analysis platforms and news outlets to track updates and adjust investment strategies accordingly.

Potential Future Scenarios and Market Implications for tariffs

Understanding the range of potential market scenarios helps investors better prepare for uncertainties.

Best-Case Scenario for tariffs:

- The U.S. successfully renegotiates trade agreements, reducing tariff pressures and stabilizing supply chains.

- Domestic production expands, creating jobs and reducing reliance on foreign imports.

- Stock markets could experience significant rebounds as profit margins recover, especially in technology and construction sectors.

Likely Scenario:

- Trade tensions persist but are managed through gradual policy adjustments and diversification of supply chains.

- Companies absorb higher costs and pass some to consumers, leading to moderate inflation.

- Market volatility continues but stabilizes within a 12-18 month period as industries adapt, with investors potentially benefiting from dividend stocks and diversified portfolios.

Worst-Case Scenario:

- Trade disputes escalate, leading to a cycle of retaliatory tariffs.

- Supply chain disruptions intensify, causing shortages and sharp cost increases, particularly in technology and agriculture.

- Prolonged market downturn could lead to significant stock declines, forcing companies to restructure operations or downsize, thereby increasing unemployment and reducing consumer spending.

Risks and Considerations in the Current Market Landscape

While these strategies offer pathways to mitigate risk, several uncertainties remain:

- Policy Reversals:

- Trade policies are subject to change based on political dynamics and global negotiations, posing unpredictable risks to long-term investment strategies.

- Global Market Reactions:

- Retaliatory measures from trade partners could escalate global market instability and introduce further risks to international investments.

- Sector-Specific Risks:

- Certain industries may face prolonged challenges, especially if supply chain disruptions persist. Tech companies dependent on foreign components may require years to restructure sourcing strategies.

This content is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on individual goals and risk tolerance. Consult with a licensed financial advisor for personalized guidance.

Conclusion

The evolving landscape of U.S. trade policies in 2025 presents both challenges and strategic opportunities for investors. Understanding the nuances of these policies and their sector-specific impacts is essential for making informed investment decisions. Employing strategies such as diversification, focusing on domestic production, and monitoring policy developments can help investors navigate this uncertain terrain. Remaining adaptable and informed will be key to sustaining long-term portfolio growth amid ongoing economic changes.

For more insights into investment strategies, market trends, and financial analysis, stay connected with Financial Monkey Blog.

Sources The information in this article has been gathered from reliable and current sources, including:

Timeline of 2025 U.S.-Canada Trade War – Wikipedia

S&P 500 and Tariff Fears – MarketWatch

Trump Trade War with Canada – MarketWatch

Leave a Reply

You must be logged in to post a comment.